Every Gift Matters

Since 1953, UCP Heartland has provided caring services for people living with disabilities throughout our local community. Over the years, our mission has thrived thanks to the compassion and generous giving of time, talents, and donations by individuals, families, and corporate philanthropic communities here in Missouri and beyond.

Every gift matters.

Your support enables UCP Heartland to continue growing and innovating so we can offer the highest quality programs and services for people living with disabilities for years to come. We have many ways you can donate to UCP Heartland. Take the time today to find the one(s) that work best for you and your family.

Annual Giving Circles

Matching Employers

Every gift to UCP Heartland makes a difference, but you can double the difference your donation makes with our matching gift program. Many corporations have donor match programs that allow them to match, often 1:1, an employee’s donation to a non-profit organization. This is an easy way to make a big difference in the lives of those we serve.

Contact your HR department today to find out if your employer matches donations and how to submit a matching gift request.

Tribute Gifts

You may give your gift online, by phone at 314-994-1600, or by mailed check to UCP Heartland, VP of Community Development, 4645 LaGuardia Drive, St. Louis, MO 63134.

Honor Gifts

Please include the honoree’s name and mailing address, so that we may notify that person of your thoughtfulness. We will include your name and address. Please let us know if you would prefer to remain anonymous.

Memorial Gifts

Please include the name(s) and mailing address(es) of the family member(s) to whom you would like an acknowledgment sent, as well as their relationship to the deceased. We will include your name and address, but we will not disclose the gift amount. Please let us know if you would prefer to remain anonymous.

Tax Receipt

When you make a Tribute Gift, an acknowledgment letter will also be sent to you, the donor, that can serve as your tax receipt.

Planned Giving

Frequently Asked Questions

Who can do planned giving?

Anyone and everyone! Planned giving is easy to do and you don’t have to be wealthy to do it.

What assets can my planned gift involve?

There are many assets you can designate for planned giving, such as a home or property, a life insurance policy, real estate, stocks, business holdings, a checking or savings account or simply naming UCPH in your will or trust for a modest amount.

Can my gift generate an income stream?

Sometimes, yes. In return for the donation of real estate, stocks or other assets, you can receive a series of regular payments.

Can my planned gift provide tax benefits?

Depending upon the type of gift, short-term and/or long-term tax benefits may apply. Donors at a variety of income levels can benefit. Be sure to consult with your financial or estate planner for more specifics.

Can my gift work in tandem with other family priorities?

Yes! Planned giving is not an “all or nothing” option. Gifts can exist side-by-side with other beneficiaries and personal priorities.

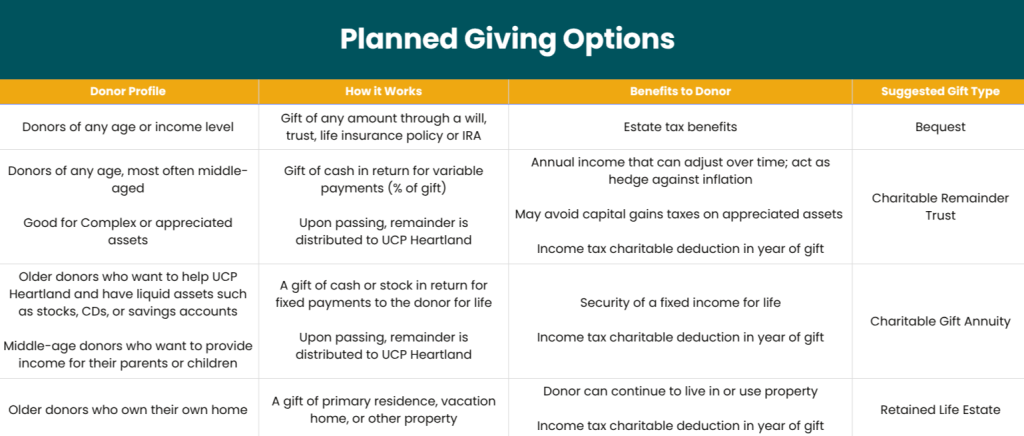

Check out the chart below to see UCP Heartland’s planned giving options in more detail.

Tax Information: UCP Heartland is a 501 (c)(3) non-profit organization and contributions are tax-deductible to the extent permitted by law. The EIN Number is 44-0579903.

Become a Monthly Donor

UCP Heartland meets families where they are and guides them toward a brighter future. Contact us today to learn more about our programs and resources that help children and adults with disabilities and their families flourish.

- ACG

- AIG

- Allianz Global Corporate & Specialty

- The Amgen Foundation

- Aon Foundation

- AT&T Higher Education/Cultural

- The Auto Club

- Automatic Data Processing

- AXA Foundation Matching Gifts Administration

- Bank of America

- Belden Inc.

- Bituminous Insurance Companies

- BlackRock

- The Boeing

- BP Matching Fund Programs

- Brown Shoe Company, Inc.

- Bunge North American Foundation Matching Gift

- Burlington Northern Santa Fe

- Cardinal Health

- Cee Kay Supply, Inc.

- Chevron Humankind

- Chubb & Son

- CNA Matching Gift Plan

- Coca-Cola

- Covidien Employee

- Duke Realty Corporation

- EADS North America

- Eaton Corporation

- Eli Lilly and Company

- Elsevier

- Emerson

- Energizer

- Equifax

- Esse Health

- Exxon Corporation

- Follett Corporation

- Forest Laboratories, Inc.

- Arthur J. Gallagher Foundation

- Gallus Biopharmaceuticals

- Gannett Foundation

- Gateway EDI, Inc.

- The GE Foundation

- Genentech Employee Giving Program

- GlassHouse Technologies, Inc.

- GlaxoSmithKline

- Grainger Matching Charitable Gifts Program

- Henry Crown & Company

- Hillshire Brands Matching Grants Program

- The Home Depot Matching Gift Center

- IBM Corp.

- Illinois Tool Works

- Invest in Others Charitable Foundation, Inc.

- Ironshore

- Johnson & Johnson

- Johnson Controls Foundation

- JPMorgan Matching Gift

- Koch Development Co

- The Kraft Foods

- Laclede Group

- Lincoln Financial Group Foundation, Inc.

- Macy’s Foundation

- McGraw-Hill Companies, Inc.

- Merck

- Microsoft

- The Millipore Foundation

- MONSANTO Matching Gift Center

- Morgan Stanley Annual Appeal & Charitable Spending Program

- Neiman Marcus Group

- Newfield Exploration Company

- Northern Trust Corp. Matching Gift and Volunteer Grant Program

- Novus International Inc.

- Olin Corporation

- Oracle Corporation

- Pacific Life Foundation

- PepsiCo Foundation

- The Pfizer Foundation

- PNC Foundation

- The Prudential Foundation

- Qualcomm Incorporated

- Regions Financial Corporation

- RGA

- Rockwell Automation

- SAP

- Savvis

- Schneider Electric/Square D Foundation

- Charles Schwab Foundation Employee

- Scottrade, Inc. Charitable Giving Program

- Stauder Technologies

- Takeda Pharmaceuticals North America

- TCF Foundation

- Thomson Reuters

- U.S. Bank Foundation

- U.S. Cellular

- UBS Foundation USA

- Union Pacific

- Verizon Foundation

- Western Union Foundation